The environment of the German private equity mid-cap market remains challenging – active portfolio company value enhancement instrumental to achieving target IRRs

Rothgordt & Cie.’s advisory practice has significantly shifted its focus towards portfolio company optimization and there’s good reason for it: Following the trend of the second half of 2012, many target companies in the German private equity mid-cap market are of only moderate quality. Additionally, in light of a volatile and uncertain economic situation, over-ambitious management plans become more and more prevalent. Highly competitive M&A processes coupled with stunning price expectations further constitute the reality of many divestment processes.

At the same time, the availability of equity in the market remains high and financing leverages of 45-55% are far away from peak times of the past.

As a result, many of the current private equity deals will only generate attractive IRRs, if the ambitious management plans will be fulfilled and if partly even further value enhancement will be achieved beyond the plan.

Common pitfalls right away after closing

In reality, a certain post-acquisition deal fatigue of the target’s management and its sponsors occurs after closing. Various suppressed operational issues or simply the daily business move back into management’s focus, and strategic roadmaps to fulfill the ambitious management plan fade from the spotlight. At the same time, the rigor during the negotiation and due diligence phase is not translated into equal enthusiasm of collaborative teamwork post-closing.

Additionally, investors presume their investment theses and financing documents represent a clear strategy and solid plan; however, in reality, the documents are mostly developed with limited access to company facts and under the context of courtship. As a result, the guardrails imposed by the investor are more of financial than of operational or strategic nature and have a clear emphasis on downside protection rather than upside aspiration.

On the other side, a management plan compiled in the context of a divestment process, by nature, represents the most flowery way of planning a business. There is no other option than to adjust this plan to meet reality. However, what we come across in our practice is frequently a wait-and-see attitude of investors, often leading to dissatisfaction with financial performance and substitution of management teams. Post-acquisition focus is frequently put on the implementation of controlling and reporting as well as current important short term operational issues. Although its importance and value is broadly recognized, a commonly developed, ambitious yet realistic strategy, and an action roadmap addressing the most fundamental value drivers is often postponed in favor of other, seemingly urgent issues.

Finally, and not surprisingly, in small and mid-cap companies we regularly observe a lack of systematic and pragmatic approaches of strategy and business plan implementation which are usually not part of the companies’ management processes.

What do the best private equity firms do? Three main differentiating success factors:

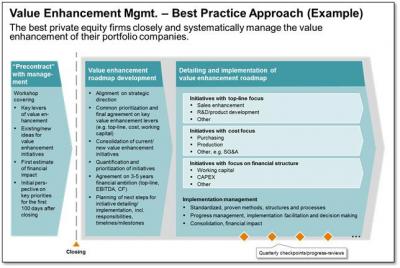

- The most successful private equity firms lay the basis for the value enhancement roadmap already prior to closing, if possible. A focused dialogue with management laying the foundation of the future cooperation in case of a successful transaction is accomplished in the pre-acquisition phase.

- The best private equity firms apply a proven, systematic approach to develop a joint value enhancement roadmap immediately after closing and jointly with the management (ideally under consideration of the exit strategy). In this roadmap a clear understanding of the companies’ strategic direction, major value enhancement levers, the implementation processes and respective responsibilities are determined.

- The most successful private equity firms take an active role in co-managing the roadmap implementation. The implementation success is facilitated by standardized and proven methods, structures and processes including common performance reviews and checkpoints.