Purchasing: One of the most underleveraged areas to free up cash in mid-cap companies –

Rothgordt & Cie. offers proven toolkit to analyze and realize full potential

Times are getting rougher: Growth rates are declining and many business plans, both top and bottom-line fall behind projections. Thus, an active investors’ involvement in portfolio company management becomes more and more crucial to secure cash flow expectations and IRR targets.

Through our work with private equity owned mid-cap portfolio companies and our numerous comprehensive due diligence mandates, it became obvious to us that one of the most unexploited potentials to free up cash short- to mid-term lies within sourcing:

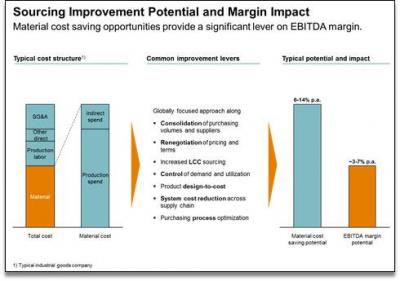

- Material cost represent the most significant cost category, typically accounting for 40-55% of total cost (based on a representative sample of Rothgordt & Cie.’s mid-cap client base). Consequently, small performance improvements in procurement translate into noticeably positive EBITDA and cash flow impacts

- Both cost saving ambitions and achievements are low. Many companies are satisfied with annual cost saving targets in the range of 1-2% that retrospectively, in many cases, are not even achieved.

- Many mid-cap companies stay far behind their purchasing full potential, e.g. due to:

- Relatively low share of low cost country sourcing

- Inconsistent cross-site/cross-plant sourcing

- Undermanaged B and C purchasing categories in production spend

- Substantially undermanaged indirect/non-production spend

- In-transparency of procurement spend along aggregated/manageable purchasing categories and a lack of system support

Based on Rothgordt & Cie.’s experience within private equity owned mid-cap companies, undiscovered annual cost saving potentials typically amount to a realistic range of 6-14% (depending on industry, key purchasing categories and past performance). Those cost savings translate into substantial margin improvement (~3-7% per year) and corresponding cash flow upsides.

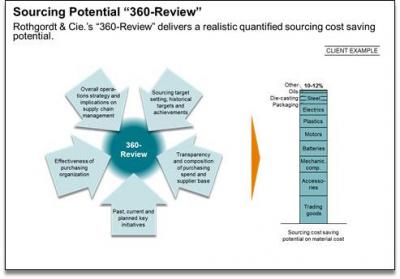

Rothgordt & Cie. has developed a proven approach to quantify a realistic sourcing cost saving potential within a few days. This approach is based on a comprehensive “360-review”, key spotlights comprise:

- Overall operations strategy and implications on supply chain management

- Sourcing target setting, historical targets and achievements

- Transparency and composition of purchasing spend and supplier base

- Past, current and planned key initiatives

- Effectiveness of purchasing organization

To materialize the identified cost saving potential in a next step, Rothgordt & Cie. can rely on substantial experience in sourcing cost optimization. A senior and dedicated leadership team with broad experience in working with both, management of mid-cap companies and private equity owners, provides an excellent track record. Depending on the operational needs and expertise requirements on purchasing item level, we are able to selectively include purchasing specialists from our established expert network.

Sourcing cost optimization is promising:

- Relatively short timeframe to achieve measureable P&L impact – In a focused sourcing optimization effort with Rothgordt & Cie., substantial first measurable P&L impact can be achieved within a few months. More than 80% of the envisioned savings potential usually becomes effective within 18-24 months.

- Limited up-front investment needs – An effective setup and process to materialize sourcing potentials in a focused approach does not require substantial pre-investments.

- Above-average acceptances of mid-cap organizations for sourcing optimization – Purchasing programs usually have very little impact on headcount. Therefore, the organizational resistance is typically lower than for transformational changes.

Rothgordt & Cie. is committed to completely align interests with its clients and work on success based fee schemes. If you are interested in a purchasing audit for one of your portfolio companies or having a more general discussion about sourcing and portfolio company value enhancement, please contact us.